Moving Beyond Product-Market Fit

Nested Fitness and Competitive Coherence throughout Company Development

Fitness is not a point. It is a path, revealed only in relation to the system it lives within.

Biological and Company Fitness

Product-market fit is a phrase that’s become canon in startup mythology. It marks the moment a product finds traction in a real, reachable market. It’s that blissful phase where customers pull the product out of your hands, referrals blossom, and retention charts curve up and to the right. Marc Andreessen defined it succinctly: being in a good market with a product that can satisfy that market.

This framing is practical but incomplete. It risks suggesting a binary outcome. You either have fit or you don’t. However, fit lives on a spectrum rather behaving like a threshold and is not an isolated milestone. It is one layer in a deeper, recursive system of relationships embedded in a much larger ecological system.

In evolutionary biology, fitness is context-dependent. A biological trait is not universally advantageous; it is advantageous in a specific environment. The environment imposes selection pressures on populations and they respond by expressing configurations of traits (aka phenotypes) that compete to persist. Let’s carry this concept into the startup world with a simple analogy:

Product → Phenotype

Market → Environment

Fit → Fitness, in the evolutionary sense

where the market applies selection (preferences, trends, frictions) and products express traits (features, price, UX, brand) that compete for survival. Fitness in this context emerges from the product’s interaction with its market.

The purpose of the following exercise is to weave a bit of math into our analogy to serve as a foothold to expand product-market fit into a set of 5 core fits that can help entrepreneurs evaluate their company’s competitive fitness during development.

The big value add in my opinion is in the Interpreting the Core Fits section. Feel free to skip ahead.

The Fitness Function

In early biology, fitness was often defined as reproductive success. As the field evolved, fitness began to be treated as an optimization problem defined over a multidimensional space of traits and tradeoffs. In evolutionary computation (a set of biology-inspired computer science approaches to optimization), fitness as a concept is a bit more tangible through a clean objective function, f, which can take the form:

Here, oi represents the value of the ith objective (things like accuracy, latency, memory efficiency, robustness, etc.). The weights wi encode the importance of each objective in the context of the problem the algorithm is to be used in. This framework is foundational to evolutionary algorithms, where candidate solutions are evolved and evaluated based on their fitness score.

I’m going to use this structure to metaphorically map onto startup development. If we let the sum of the weights reflect the trait set comprising a product (the product’s phenotype), and the objectives reflect the challenge of a trait set satisfying a market expectation (environmental pressures of the market), then a reformulation emerges:

Here, Product reflects the aggregate product design intent and Market reflects the aggregate resistance imposed by market constraints. By taking liberty in bounding the parameters, we can interpret 1) The higher the resistance, the lower the fitness and 2) the stronger the alignment between a product’s trait set with the market, the closer the fitness gets to unity, 1. Fitness in this view is an emergent ratio between product aspiration and market constraint. (Note: keeping fitness <= 1 allows us to interpret these as probabilities which helps a bit in the following section.)

By the way, this is far from an empirical derivation. The math gives us just enough scaffolding to allow us to extend this analogy with a sturdier structure.

Company Fitness: A Nest of Relational Fits

Product-market fit is often framed as the singular milestone that defines startup success. I propose product-market fit is one alignment in a cascade of nested core fitness relationships, each a necessary condition for the next.

I believe a company’s overall fitness can be represented as a product of several such core fits:

Each fit evaluates coherence between one concept and its operating context at a particular scale. From a probability perspective, this reads as “The likelihood a company is fit depends on its solution-problem fitness AND its problem-product fitness AND … AND its plan-industry fitness.“

This left-to-right ordering is intentional. It mirrors the developmental arc of a startup:

Ideation stage: Evaluate Solution-Problem Fit

Prototyping stage: Assess Problem-Product Fit

Seed stage: Validate Product-Market Fit

Series A–C stage: Prove Market-Plan Fit

Public stage: Align Plan-Industry Fit

At each stage, a new kind of fitness becomes critical to evaluate. Downstream company success and competitiveness is conditional on upstream coherence. For example, if the initial pairing of a startup’s solution to the problem its addressing is weak, the company’s product-market fit will be compromised.

This likely feels obvious and intuitively true (which is a nice sanity check), but having these core fits as distinct referenceable competitiveness checks is valuable in and of itself. Just the cognitive invitation to consider your company’s core fits will likely lead to a more competitive company.

A company is not fit merely because its product is good or even because its market is large. It is fit only when each layer in the fit stack supports the next, when competitive coherence is preserved from the first spark of an idea all the way to industrial integration.

(I wanted to incorporate the notion of relative competitiveness to further contextualize these core fits with respect to other company’s approaches, but I think the conceptual gains wouldn’t outweigh the clarity sacrificed. I might expand this into likelihood functions and fitness landscapes in a future post.)

Interpreting the Core Fits

Each of the core fits represents a practical and structured evaluation point. They explore whether a set of design choices and assumptions competitively align within a specific context. Let’s unpack these layers one by one, using Uber as an example.

Solution-Problem Fit

Stage: Ideation

This is the founding alignment. It is the only fit in which both the design and context components are chosen by the entrepreneur. Its also worth taking a moment to distinguishing between a solution and a product because the terms are often used synonymously. A solution is a proposed way a specific tension in the world could resolve, whereas a product the conduit that delivers the solution. A solution can only reach a market through a product’s unique capacity to interface with a market.

Uber’s proposed solution was peer-to-peer transportation. The problem was identified to be the unreliable, scarce taxi infrastructure in urban areas. The fitness evaluation: How competitively does the concept of peer-to-peer transportation alleviate urban taxi scarcity? This is a test of conceptual adequacy, exploring if the core solution idea competitively maps to the shape of the problem.

Problem-Product Fit

Stage: Prototyping

With the problem being inherited from the solution-problem fit, the product, i.e. the engineerable interface between a solution and a problem, needs to be identified. Uber’s product was found to be a mobile application. The fitness evaluation: How competitively can the problem of taxi scarcity be addressed by a mobile application?

Do the constraints of the product design correspond to the structural features of the problem? This is a test of implementation feasibility.

Product-Market Fit

Stage: Seed

Now that a product exists, the entrepreneur needs to identify if a market (the psychological and economic context) in which that product can be best offered. Uber’s early market was urban professionals in cities where taxi systems were inefficient or hostile to demand. The fitness evaluation: How competitively does this mobile application resolve the taxi access problem for this market in a way that activates willingness to pay?

The market is more than a demographic. It is a behavioral substrate. It includes user psychology, spending readiness, pain sensitivity, and ambient cultural expectations. Product-market fit asks whether the product matches this behavioral profile tightly enough to unlock exchange.

Market-Plan Fit

Stage: Series A-D

Once a suitable market has been identified, the company must now articulate a business plan, a structured architecture for creating, delivering, and capturing value at scale. Uber’s business plan involved dynamic pricing, city-by-city network expansion, driver onboarding incentives, and eventual expansion into logistics and food delivery. The fitness question becomes: Can this market structure competitively support the mechanisms, assumptions, and scaling dynamics embedded in the business plan?

This is a test of structural alignment. It asks whether the rhythms and constraints of the market can support the operations and economics that the plan requires to function.

Plan-Industry Fit

Stage: Public or self-sufficient

At scale, the business plan must be able to operate within the deeper landscape of the industry. The industry includes regulation, incumbents, capital access, infrastructure, and cultural narratives. Uber entered a highly regulated and politically sensitive transportation ecosystem. Its plan directly challenged entrenched interests, but did so with significant legal foresight and capital support. The fitness question becomes: Can the structure and strategy of this business plan function competitively within the industrial environment it inhabits?

This is a test of systemic coherence. It asks whether the plan can survive and evolve in the face of the real dynamic constraints imposed by the industry’s capital, culture, and discovery.

Extracting Fits of Scale

Each layer is its own fitness function, but their composition is multiplicative. The implication here is that if every layer shares coherent parameters, i.e. the same driving assumptions, technologies, value propositions, and core truths, the chain can be simplifies and new fits that bridge developmental scales begin reveal themselves. For example, a prototyping staged company needs to be considering both Solution-Problem Fit and the Problem-Product Fit. A good measure of how fit the company is as a whole can be extracted as a scaling fit as intermediate ratios cancel under the assumption of coherence

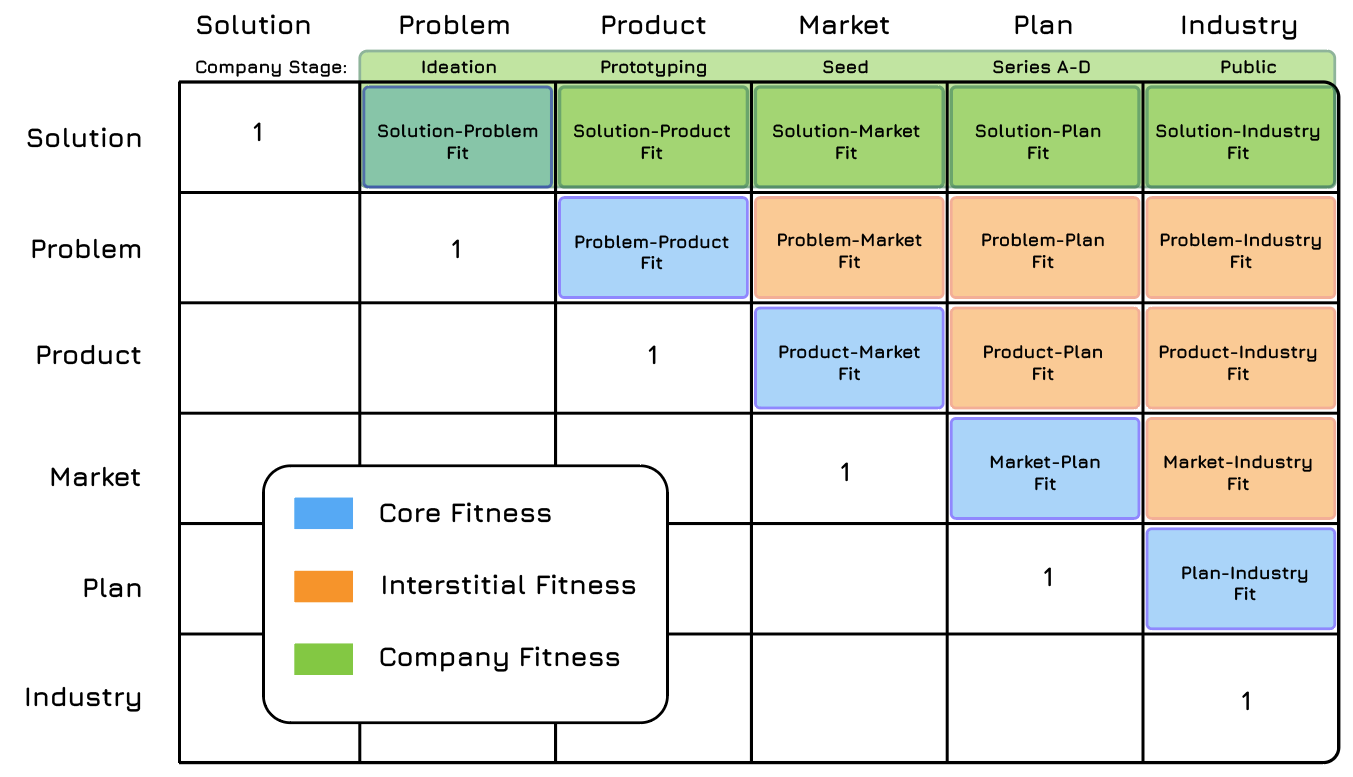

In this instance the Solution-Product Fit, or how well the solution can be delivered through the designed product, is a good proxy to clock the overall fitness of an early company in their prototyping stage. Similarly, one can combinatorially consider other intermediate simplifications to find interstitial fits like Problem-Market, Product-Plan, or Market-Industry Fits (see Figure 1, orange boxes). Each can have their own conceptual power in dissecting regions of optimization for companies throughout their development.

With the fundamental concepts of solution, problem, product, market, plan, and industry, one can construct a fitness matrix to extract sets of core fits, interstitial fits, and company fits.

Figure 1: Company Fit Matrix. Upper triangle of matrix identifies core, interstitial, and company fits. Lower triangle left blank due to symmetry.

Moving back to the company fits, all of which are of the form Solution-X Fit (see Figure 1, green boxes), the initial motivation of this thought exercise I undertook reveals itself. I seeded this thought experiment by asking truly what makes a company fit? From this thought exercise I uncovered that

leaving us with simply

This distillation captures something profound:

The ultimate measure of a company’s value isn’t in how shiny the product is or how clever the strategy is, it’s in how precisely and powerfully the solution maps to the industry its being injected into.

It’s a reflection not of what you built, but the competitive advantage your proposed relief has on relieving an industrial tension.

Closing Thoughts

The mathematical scaffolding here helps shape the idea, but its quantitative utility fades quickly beyond providing conceptual structure. The real work of defining the design and context components of fitness remains instinctual and evaluating fitness remains partially empirical. The startup organism is complex and survives by competitively metabolizing the entangled domains of capital, culture, and discovery

Looks like some of the LaTeX doesn't display well in-app or on mobile. Seems to work on PC browsers, but not super critical either way.